How to verify cash transaction post demonetisation with Income Tax Authorities

After demonetisation people rushed to deposit their underlying cash. They deposited their scrapped currency notes in their Bank Accounts. Government Agencies haven’t yet released data for quantum of deposits made. Estimates from different sources suggests that most of these scrapped currency notes found their way into Banks. Now, it’s time for accounting those cash deposits.

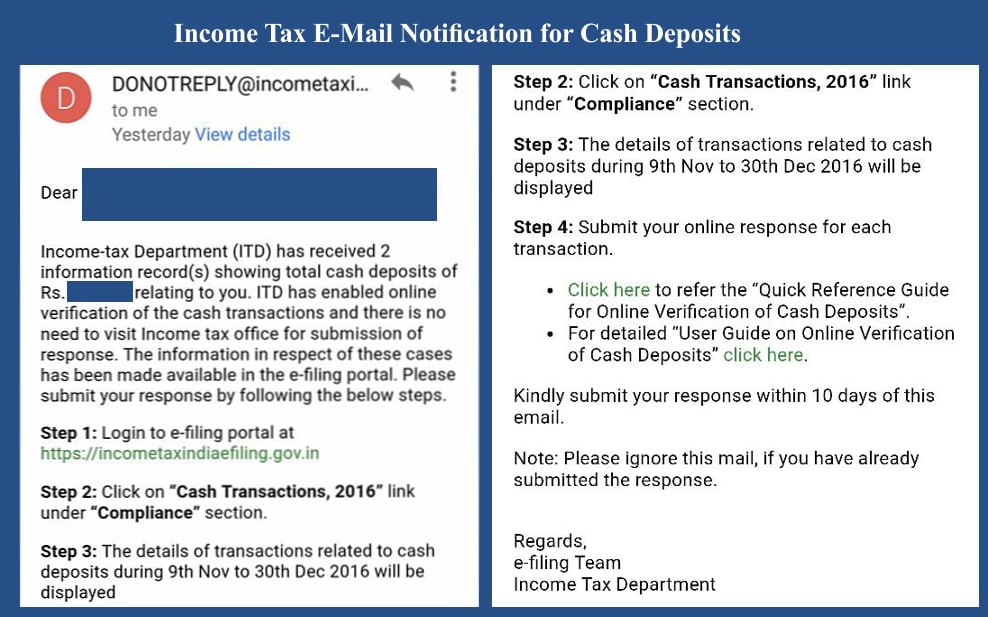

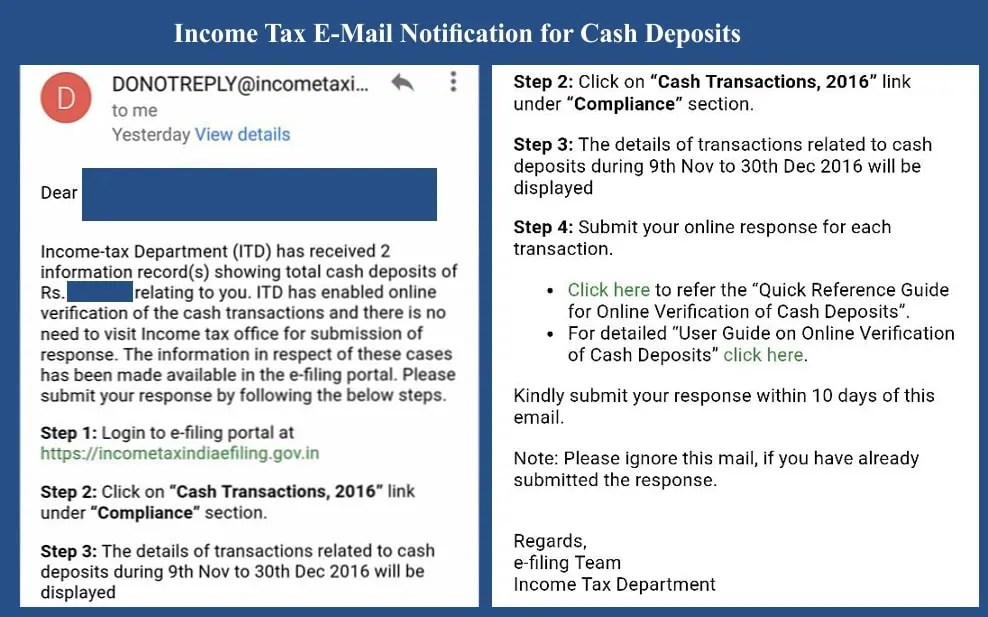

Earlier, Finance Minister Shri Arun Jaitley said that Income Tax Department is using Data Analytics. Income Tax Department has collected data for cash deposits made in Bank Accounts post demonetization. Tax Department has started sending emails to those Bank Accounts in which deposits of cash above ₹ 2 Lacs were made. Automated System of Income Tax Department of India has started sending email notices to those PAN holders whose Bank Accounts saw deposits that are not matching with their Tax Profiles. Department has said that it is in process of sending such mail notices to 18 lakh depositors across the country. In order to make the process easy for taxpayers, this notice contains details on how to respond to it.

People who have received such Email from Income Tax Department, do not need to submit their responses in hard copies. They can log into their Income Tax E-filing Account and submit their responses.

If you haven’t created your E-filing Account yet, you can use this link to know how to register with Income Tax authorities. And in case, you do have an e-filing account but have forgotten your login details, you can use this link to Reset your Income Tax E-filing Account.

Once, you receive Email Notification, you will have to give your response. The purpose of Income Tax Department at this stage is to provide an easy way for innocent taxpayers in explaining their cash dealings. Unlike in the past, when assessee (Taxpayers to whom notices are issued) had to represent his case either himself or through his authorized representative in person, this time there is no need to give a response in person. Instead, taxpayers can simply file their online responses. To file their responses, they will have to follow below steps:

Step 1

- Login to their Income Tax E-filing Account.

- Navigate to “Compliance Menu” and Select the Menu of “Cash Transactions 2016”.

- Once, clicked it will open a page with a list of all cash transactions recorded by Income Tax Department.

[Not every cash transaction will be present here. Only those transactions that are received by Income Tax Department from several sources such as from Banks (for cash deposits) and other sources will be listed here.]

Step 2

- Click on the item listed for which you want to file your response. Here, in this cash transaction with this PAN. However, if your PAN had been found to be used with any cash dealings (including cash deposits in Bank Account), those transactions will be listed here. You will have to select it and click on ‘file response’ option.

- In response, you can explain whether that transaction is true or not. If your PAN is used to make deposits to different Account that doesn’t belong to you, you can say the same. Income Tax Department will initiate further action on it.

- You can file response to cash deposits made out of savings that you made in earlier years. You can put details of such transaction in remarks. You can also correct the amount if PAN details are correct but amount listed is incorrect.

- For Cash Transaction that occurred out of money received from agricultural sources (including sale proceeds from agricultural income) and exempt sources, you can provide relevant details along with your remarks.

This process is made easier by Income Tax to assist taxpayers. If you face any difficulties, income tax department has support services too. You can either reach to them via online grievance and support section. It has toll free no. 1800 4250 0025. You can call them for assistance related to your e-filing account.

These E-mail notices are technically not Notices as per Income Tax Act. Income Tax Department is saying that in whole process there is no involvement of human. Questions are made simple and if when answered, responses are matched by the system with available information. Depending upon the risk profile, a case can automatically be closed. For example, if money is deposited into Pradhan Mantri Garib Kalyan Yojna (PMGKY) and the response is made accordingly, no further investigation will be made. Tax Payers need to file their responses within 10 days. After which notices under income tax act for inquiry of information will be issued by the department. So, don’t waste your time. Login to your Income Tax E-filing Account and file your responses.

Share this post on: Facebook Twitter (X)

Previous: How to Reset Login of Income Tax E-filing Website Next: Income Tax Slab Rates for FY 2016-17 (AY 2017-18)CA Raj Kumar

I love blogging and studying taxation. I write articles related to Tax laws and common issues in handling taxation in India. Often, common but small mistakes make things complicated. I write and share them to save precious time of others.

Leave a Reply