How to Register with Income Tax Authorities

To register online with Income Tax Department, you will need your PAN Details. To Proceed with registration, you can follow these steps:

Step 1

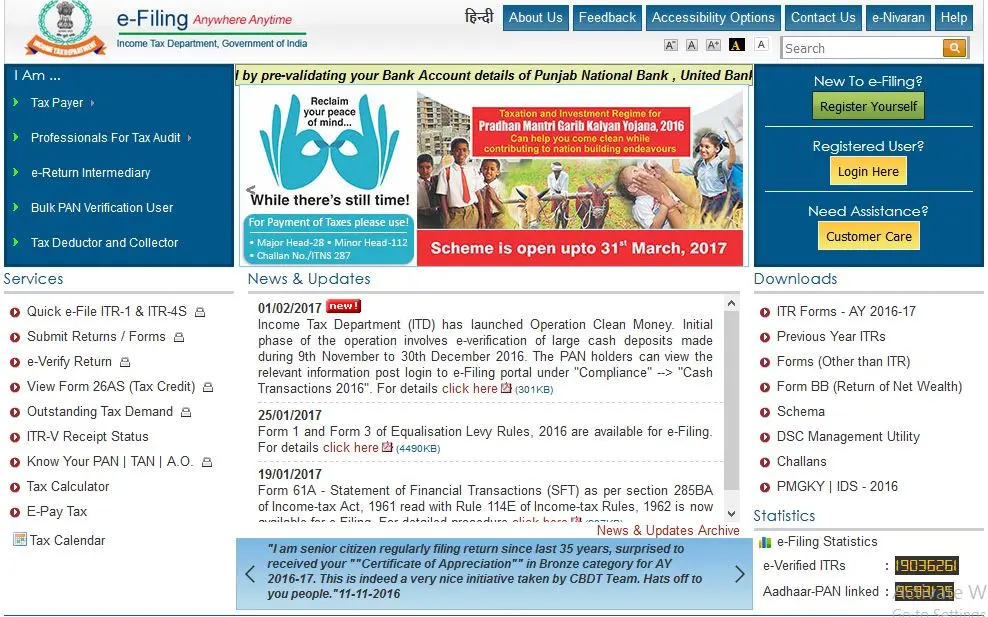

- Go to [button color=”black” size=”” type=”3d” target=”” link=”https://incometaxindiaefiling.gov.in”]Income Tax E-Filing Website[/button]

Step 2

- Click on Register, to start Registration Process.

Step 3

- Select your user type. If you want to register for yourself in an individual capacity, you need to select Individual. For HUF and other profiles of entities, you need to select respective option.

Step 4

- On next page, you need to enter details of your PAN. You should enter your Name as Surname, Middle Name, and First Name.

- In case you don’t have any Middle Name, you can leave it blank.

- You also need to Enter your Birthdate that you used for obtaining your PAN Card.

- For HUF, Birthdate is the date of formation of HUF. For other entities, this date is Date of Incorporation (for Companies)/Registration.

Step 5

- Provide your Personal Details. For HUF, you can enter details of Karta.

- You need to provide Email and Mobile No. for receiving OTP. On receiving OTP, you can verify it and your registration will be complete.

After you have successfully registered your Account with Income Tax Department, you can now login to your account. On logging in for the first time, you will be asked to update your Adhar Details. You can either choose to update it or choose to update later on.

There are several benefits to registering your Adhar Details with Income Tax Authorities. With Adhar No. linked to your Account, you no longer have to send your return in hard copies to CPC, Bangalore. All the taxpayers who do not have DSC to sign their returns digitally can e-verify their returns through Adhar. If Adhar is not linked, they will have to send their returns in hard copies to CPC, Bangalore so that their return will be verified and processed.

With such easy steps, you can register yourself with Income Tax Department. You will be able to file and view your returns online. Also, you can respond to income tax notices online by logging with your E-filing user id and submitting your responses. This will save your time and is a very convenient way of dealing with Income Tax Department.

Share this post on: Facebook Twitter (X)

Previous: Repurchase Options (Repo.) and Ready Forward contracts Next: How to Reset Login of Income Tax E-filing WebsiteCA Raj Kumar

I love blogging and studying taxation. I write articles related to Tax laws and common issues in handling taxation in India. Often, common but small mistakes make things complicated. I write and share them to save precious time of others.

Leave a Reply