How to Reset Login of Income Tax E-filing Website

It may be very often that you forget your password for Income Tax E-filing Website. Since it is needed only a few times a year, anyone can develop the habit of forgetting it. Don’t worry, there is nothing to worry about. Income Tax Website is one of the few governmental websites that is made purposefully easier for taxpayers. You can reset it easily in few minutes. Just follow the steps below:

Step 1

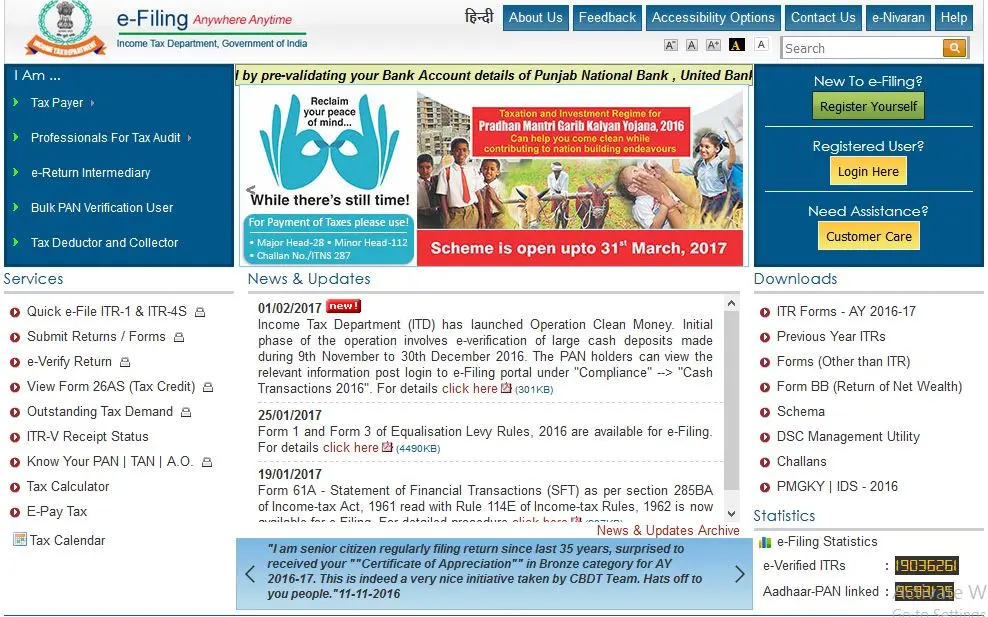

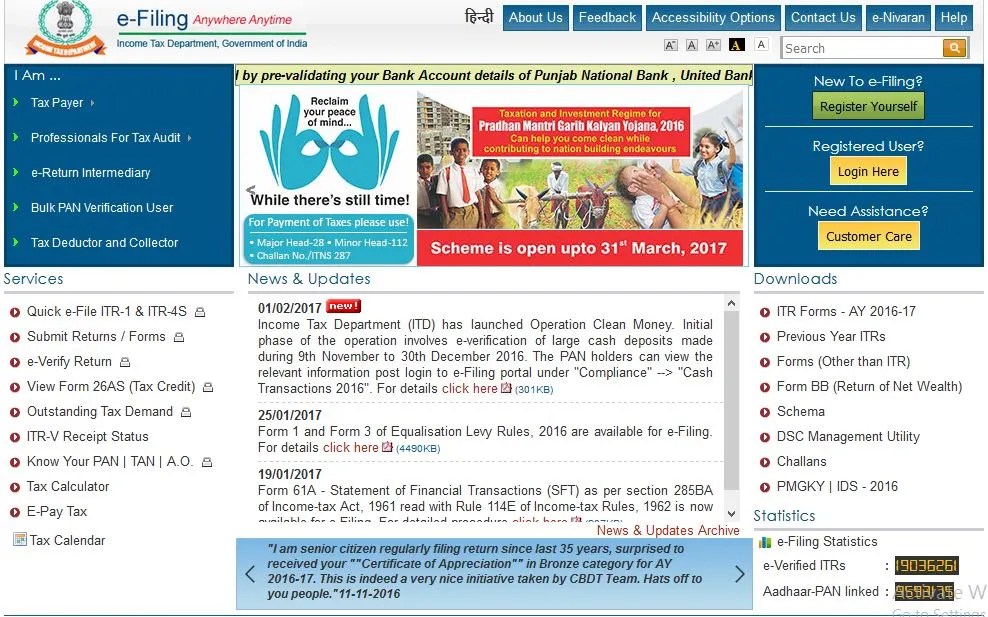

- Go to [button color=”Black” size=”” type=”outlined” target=”” link=”https://incometaxindiaefiling.gov.in”]Income Tax E-filing Website[/button]

Step 2

- Click on Login Button to open Login Page.

Step 3

Step 3

- Click on Forget Password button.

It will open a new page that will ask your username and details.

It will open a new page that will ask your username and details.

- Username for Income Tax E-filing website is your PAN no.

- Just Enter your PAN No. followed by your Date of Birth and choose the method through which you want to reset your Password.

It can be reset by DSC (Digital Signature) if it has been already registered with income tax department.

It can be reset by DSC (Digital Signature) if it has been already registered with income tax department.

- It can also be reset by just entering a security question. Upon answering the correct security question, page for setting a new password will open up.

Step 4

- Once, you set up your new password, you can login back to your account.

- For confirmation, your registered email id will receive notification of changing the password.

This is an easy way to reset your password for the e-filing website. Hope it helps you in recovering control over your Income Tax Efiling Account.

This is an easy way to reset your password for the e-filing website. Hope it helps you in recovering control over your Income Tax Efiling Account.

Share this post on: Facebook Twitter (X)

Previous: How to Register with Income Tax Authorities Next: How to verify cash transaction post demonetisation with Income Tax AuthoritiesCA Raj Kumar

I love blogging and studying taxation. I write articles related to Tax laws and common issues in handling taxation in India. Often, common but small mistakes make things complicated. I write and share them to save precious time of others.

Leave a Reply